5 New Electric Scooters Launching In India Soon-Suzuki-Yamaha

Leading two-wheeler manufacturers Yamaha, Suzuki, and TVS are poised to introduce their new electric scooters to the Indian market within the next 7 to 9 months. This signifies a major push by mainstream players into the rapidly expanding electric vehicle segment in India.

- Suzuki: The Suzuki e-Access, which debuted at the 2025 Bharat Mobility Global Expo, is expected to launch around August 2025. Suzuki has already begun its series production at its Gurugram factory. The Burgman Electric is also anticipated by September 2025.

- TVS: TVS is planning to launch a new affordable electric scooter, positioned below the iQube, by October 2025. This model could potentially be named “Orbiter” and is expected to target the sub-Rs 1 lakh segment.

- Yamaha: Yamaha’s first electric scooter for India, internally codenamed RY01 and based on the River Indie, is likely to hit the market by early 2026. This premium offering is being developed in partnership with Bengaluru-based EV startup River.

The Indian electric scooter market is on the cusp of an electrifying surge, with at least five brand-new models set to launch within the next 7-9 months, extending into early FY26. This influx of fresh offerings underscores the unprecedented growth witnessed in the electric two-wheeler segment in FY25, prompting even more mainstream players to accelerate their foray into this burgeoning space.

Here’s a closer look at the anticipated new electric scooters poised to hit Indian roads:

- Hero Vida VX2 / Z (Hero MotoCorp): Hero MotoCorp is set to bolster its electric sub-brand Vida with new affordable models. The Vida VX2 (also referred to as Vida Z) is expected to launch on July 1, 2025. Positioned as a more budget-friendly option than the existing V2, it aims to capture a larger share of the mass market. It’s likely to feature a modular platform supporting various battery capacities (2.2 kWh to 3.4 kWh) and may even offer a Battery-as-a-Service (BaaS) subscription model to further reduce upfront ownership costs.

- Suzuki e-Access & Burgman Electric (Suzuki): Suzuki is making a significant entry into the Indian EV market. The Suzuki e-Access, which debuted at the 2025 Bharat Mobility Global Expo, has already commenced series production at its Gurugram factory. It’s expected to launch around June/July 2025 as Suzuki’s first electric scooter for India, offering an estimated range of 95 km. Following this, the Suzuki Burgman Electric, a premium maxi-scooter with an expected price around Rs 1.20 Lakh, is anticipated by September 2025.

- New Affordable TVS Electric Scooter (TVS): TVS, already a strong player with the iQube, is preparing to launch a new, more affordable electric scooter. This model, potentially named “Orbiter,” is slated for release by October 2025. Positioned below the iQube, it aims to tap into the crucial sub-Rs 1 lakh segment, possibly utilizing a 2.2 kWh battery pack for a more accessible price point.

- Ather EL-platform Scooter (Ather Energy): Ather Energy is gearing up to unveil its all-new “EL” electric scooter platform at its annual Community Day event, scheduled for August 2025. This versatile and cost-efficient platform is designed to underpin a new range of more affordable Ather electric scooters, aiming to introduce models priced closer to Rs 80,000. Ather also plans to debut its next-generation fast chargers and the upgraded Ather Stack 7.0 software with these new offerings.

- Yamaha’s First Electric Scooter (Yamaha): Yamaha is finally entering India’s electric scooter segment with a premium offering, internally codenamed RY01. This model, being developed in partnership with Bengaluru-based EV startup River and based on the River Indie, is likely to launch by early 2026. It’s expected to feature a 4 kWh battery pack, a range of 100+ km, and a top speed around 90 kmph, targeting the premium segment of the market.

The coming months promise to be a period of intense competition and exciting innovations in India’s electric two-wheeler space, as these established brands vie for market share in a segment that is rapidly transforming urban mobility.

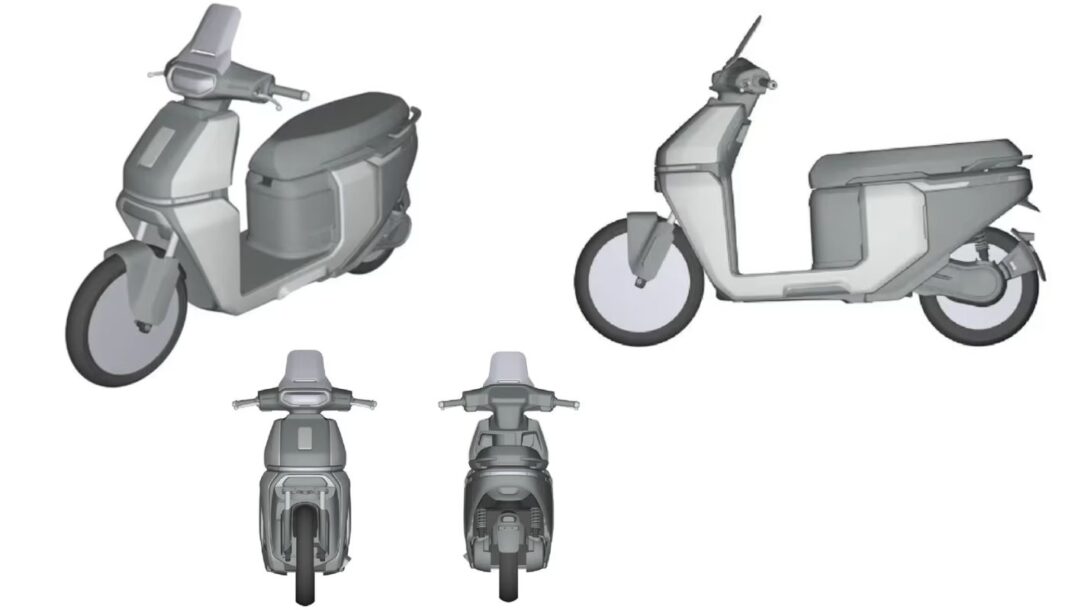

1.Suzuki e-Access

Suzuki e-Access: Suzuki’s Electrifying Entry into the Indian Two-Wheeler Market

Suzuki Motorcycle India Private Limited (SMIPL) is set to make a significant stride into the rapidly evolving electric two-wheeler segment with the imminent launch of its first electric scooter, the Suzuki e-Access. Unveiled at the Bharat Mobility Global Expo 2025, the e-Access represents Suzuki’s long-awaited and strategic pivot towards electric mobility in one of the world’s largest two-wheeler markets. With production already commencing at its Gurugram plant in Haryana, the e-Access is poised to challenge established players and carve out a niche for Suzuki in the increasingly competitive Indian electric scooter landscape.

A Fresh Design with Familiar Echoes

While sharing a name that evokes the familiarity and success of the popular petrol-powered Access 125, the Suzuki e-Access is a completely new offering built on a dedicated EV platform. Its design philosophy leans towards a modern, elegant, and somewhat sober aesthetic, diverging from the more aggressive or futuristic styling seen in some rivals. Key design elements include a sleek front apron with integrated LED winkers, a full-LED headlamp, and simple yet appealing 12-inch alloy wheels at both ends.

The dual-tone paint schemes further enhance its visual appeal, offering combinations like Pearl Jade Green/Metallic Mat Fibroin Grey, Pearl Grace White/Metallic Mat Fibroin Grey, and Metallic Mat Black No. 2/Metallic Mat Bordeaux Red. The overall fit and finish are reported to be premium, with no visible dangling wires or panel gaps, reflecting Suzuki’s reputation for build quality.

Powering the Ride: Battery and Performance

At the heart of the Suzuki e-Access is a 3.07 kWh Lithium Iron Phosphate (LFP) battery pack. Suzuki’s choice of LFP chemistry is noteworthy, as it prioritizes safety and longevity over sheer energy density, a strategic decision given India’s diverse operating conditions and consumer expectations for durability. This fixed battery is encased in an aluminum shell integrated into the scooter’s underbone frame, contributing to structural rigidity.

Powering the e-Access is a 4.1 kW (approximately 5.5 hp) electric motor that generates a peak torque of 15 Nm. This motor is swingarm-mounted and features a belt final drive system. The scooter boasts a claimed IDC (Indian Driving Cycle) range of 95 km on a single charge. While this figure might be slightly lower than some rivals using NCM (Nickel Cobalt Manganese) batteries, it is deemed sufficient for typical urban commutes. The e-Access achieves a claimed top speed of 71 kmph, making it suitable for city traffic and moderate intra-city commutes.

Charging Convenience and Modes

Suzuki has equipped the e-Access with versatile charging options. A standard portable AC charger, which is included with the scooter, can fully charge the battery from 0 to 100% in approximately 6 hours and 42 minutes. For faster charging, the e-Access supports DC fast charging, capable of topping up the battery from 0 to 100% in a significantly quicker 2 hours and 12 minutes.

Suzuki has also announced plans to install DC fast chargers across its dealerships in the initial 30 launch cities and aims to have its entire service network EV-ready by the end of 2025.

The e-Access offers three distinct riding modes – Eco, Ride A, and Ride B – allowing riders to tailor the performance to their needs.

- Eco Mode: Limits speed (around 55 km/h) and maximizes regenerative braking for extended range.

- Ride A: Provides full power with high regenerative braking, offering a balanced performance for city riding.

- Ride B: Delivers full power with less regenerative braking, allowing for smoother coasting. The scooter also includes a reverse assist function, a practical feature for navigating tight parking spaces.

Features and Rider Comfort

The Suzuki e-Access comes loaded with a host of modern features aimed at enhancing convenience and safety. The instrument console is a 4.2-inch (or 5-inch, depending on reports) TFT digital display that offers clear visibility and a plethora of information, including speed, odometer, trip meters, battery charge gauge, and ride mode display. It supports smartphone connectivity via Suzuki’s Ride Connect app, providing features like turn-by-turn navigation, call/SMS alerts, and potentially live traffic updates.

Other notable features include:

- Keyless ignition: Allowing riders to start the scooter remotely.

- All-LED lighting: For enhanced visibility and a modern aesthetic.

- USB charging port: For on-the-go mobile device charging.

- Underseat storage: While not segment-leading (around 17 liters), it provides space for essentials. The seat also features a latch mechanism that keeps it open unassisted.

- Hazard warning lights and a kill switch (which doubles as a reverse mode switch).

- Pillion footrest and grab rail.

In terms of rider comfort, the e-Access features a relatively low seat height of 765 mm, making it accessible for a wide range of riders. The seating is reported to be well-cushioned, and an extended footrest on the floorboard adds to comfort during rides. The suspension setup comprises telescopic forks at the front and a swingarm-type, coil spring,

oil-damped unit at the rear. Braking duties are handled by a disc brake at the front and a drum brake at the rear, supported by a Combined Braking System (CBS) for enhanced safety. The kerb weight stands at 122 kg, and it offers a ground clearance of 165 mm.

Market Positioning and Competition

The Suzuki e-Access is expected to be competitively priced, with estimates ranging from ₹1.10 lakh to ₹1.40 lakh (ex-showroom). This pricing positions it directly against a rapidly growing list of rivals in the mainstream electric scooter segment. Key competitors include:

- TVS iQube: A well-established player known for its reliability and range.

- Bajaj Chetak: A premium electric scooter with a neo-retro design and strong brand recall.

- Ather Rizta: Ather’s family-oriented, practical electric scooter.

- Honda Activa e: Honda’s upcoming electric scooter, likely to leverage the Activa brand’s immense popularity.

- Ola S1 X+: Ola Electric’s more affordable offering that targets the mass market.

- Hero Vida V1 Pro / VX2: Hero MotoCorp’s electric scooter models that offer features and range.

Suzuki’s strategy appears to be leveraging its brand reputation for reliability and quality, combined with a practical and user-friendly electric scooter. While its claimed range might be slightly less than some rivals, its LFP battery choice (known for safety and longevity) and the promise of a robust dealer network with EV servicing capabilities could be strong selling points for discerning Indian consumers.

2.Hero Vida VX2

Hero Vida VX2: Hero MotoCorp’s Strategic Play for the Mass Market EV Segment

Hero MotoCorp, a colossal force in the Indian two-wheeler industry, is poised to redefine its presence in the burgeoning electric vehicle (EV) segment with the highly anticipated launch of the Hero Vida VX2. Positioned as a more accessible and cost-effective offering under its Vida electric sub-brand, the VX2 is set to debut on July 1, 2025. This launch signifies a strategic move by Hero to capture a larger share of the mass-market EV space, directly challenging established rivals and newer entrants with an emphasis on affordability, practicality, and an innovative ownership model.

A Design Philosophy Centered on Simplicity and Functionality

Unlike the more premium Vida V2, the VX2 adopts a design philosophy rooted in minimalism and functionality, echoing the Vida Z concept shown previously. It features a clean and proportionate silhouette, designed to appeal to a broad demographic of urban commuters. Recent teasers and leaks indicate a straightforward yet appealing aesthetic, characterized by a smooth body design. The VX2 will be available in a vibrant palette of seven monotone colors, including White, Red, Blue, Yellow, Orange, Black, and Grey,

a departure from the dual-tone options of the V2. While some reports initially suggested the absence of a front disc brake in lower variants, implying drum brakes at both ends for cost-effectiveness, more recent information suggests a front disc brake might be available on top variants, coupled with a Combined Braking System (CBS) for safety. The overall build quality is expected to uphold Hero’s reputation for durability and robust construction, capable of handling varied Indian road conditions.

Modular Battery Options and Practical Range

A core highlight of the Vida VX2 is its versatile battery architecture. The scooter is expected to be offered in at least two variants:

- Vida VX2 Go: This base variant will likely come with a 2.2 kWh removable battery pack.

- Vida VX2 Plus: The higher trim is speculated to feature a larger 3.4 kWh battery pack, ingeniously designed with two swappable batteries.

The removable battery feature is a significant convenience, allowing users to charge the batteries at home, in the office, or at dedicated swapping stations, addressing concerns about dedicated parking and charging infrastructure. While official IDC (Indian Driving Cycle) range figures are yet to be fully disclosed, the ‘Go’ variant with its 2.2 kWh battery is anticipated to offer an approximate range of around 100 km on a single charge. This range is deemed sufficient for typical daily urban commutes, catering to the needs of the target audience.

Performance Tailored for Urban Commutes

Specific details regarding the motor’s power output for the VX2 are still emerging. However, given its positioning as an affordable, mass-market electric scooter, the performance is expected to be optimized for urban commuting. It will likely deliver a smooth, quiet, and responsive ride, with ample torque for quick acceleration in city traffic. Multiple riding modes (e.g., Eco, Ride)

are anticipated to be available, allowing riders to switch between maximizing range and optimizing performance based on their requirements. Features like regenerative braking will also be incorporated to enhance efficiency by recovering energy during deceleration.

Innovative Battery-as-a-Service (BaaS) Model

Perhaps the most revolutionary aspect of the Hero Vida VX2’s ownership proposition is the integration of a Battery-as-a-Service (BaaS) subscription model. This innovative approach aims to significantly reduce the upfront purchase cost of the electric scooter by separating the cost of the

battery from the vehicle itself. Under this model, customers would purchase the scooter chassis at a lower price and then subscribe to battery usage plans based on their needs (daily, weekly, or monthly).

This BaaS model offers several compelling advantages:

- Lower Entry Barrier: It makes electric mobility significantly more affordable, appealing to price-sensitive Indian consumers who might be deterred by the high upfront cost of an EV with an integrated battery.

- Flexibility and Convenience: Users can opt for usage-based plans and leverage Vida’s expanding network of battery swapping stations (Hero’s charging network includes over 3,600 fast chargers) for quick battery exchanges, eliminating range anxiety and charging hassles.

- No Obsolescence Fear: With a subscription, consumers don’t need to worry about battery degradation or the high cost of future battery replacements, as these are typically covered under the service plan. It also allows for seamless upgrades to newer battery technologies as they become available.

Hero MotoCorp’s extensive service network, comprising over 500 service points, is also being geared up to support the Vida EV ecosystem, ensuring hassle-free maintenance and customer support.

Features and Connectivity

While designed to be cost-effective, the Vida VX2 is expected to offer a balanced set of features. Reports suggest it will come with a TFT digital display, which might be smaller than the one found in the V2 series, possibly with physical buttons for control. Basic Bluetooth connectivity functions, including turn-by-turn navigation via a companion app (likely the Vida app)

, are anticipated. Other conveniences may include a keyhole ignition (as opposed to keyless entry in premium models), comfortable seating, and under-seat storage sufficient for daily essentials. The scooter is expected to feature LED lighting for improved visibility and modern aesthetics.

Pricing and Market Positioning

The Hero Vida VX2 is strategically positioned as an entry-level offering, with an expected ex-showroom price for the base variant likely to be under ₹1 lakh, potentially starting as low as ₹70,000 for the ‘Go’ variant under the BaaS model. The ‘Plus’ variant is estimated to be around ₹79,000, and a ‘Pro’ variant around ₹1.05 lakh. This aggressive pricing aims to directly compete with popular budget-friendly electric scooters in the market, including:

- Ola S1 Air / S1 X+

- TVS iQube (base variants)

- Bajaj Chetak (entry-level variants)

- Ather 450S / Rizta (more affordable variants)

- Hero Electric Optima

- Upcoming Suzuki e-Access

Hero MotoCorp’s vast dealership and service network, combined with the innovative BaaS model, provides a significant competitive edge, allowing the company to reach a wider segment of consumers in both urban and semi-urban areas.

The Larger Vision

The launch of the Vida VX2 is more than just the introduction of a new electric scooter; it signifies Hero MotoCorp’s unwavering commitment to democratize electric mobility in India. By focusing on affordability, convenience, and a flexible ownership model, Hero aims to address the primary barriers to EV

adoption for the mass market. This move aligns with Hero’s broader vision of making EVs accessible to a significant portion of two-wheeler buyers by 2030 and contributing to India’s net-zero targets by reducing dependence on internal combustion engines. The Vida VX2 is poised to be a pivotal model in this journey, setting new benchmarks for accessibility and practicality in the Indian electric two-wheeler space.

3.TVS Orbiter

TVS Orbiter: Ushering in Affordable Electric Mobility for the Masses

TVS Motor Company, a frontrunner in India’s electric two-wheeler revolution with its successful iQube series, is gearing up to launch a game-changing electric scooter that promises to democratize EV adoption for a broader segment of the Indian populace. While the official name is yet to be definitively confirmed, industry whispers and recent trademark filings strongly suggest this upcoming affordable model could be christened the TVS Orbiter.

Poised to slot below the popular iQube range, the Orbiter is expected to hit the market around the festive season of 2025 (October-November), strategically targeting budget-conscious buyers seeking reliable and cost-effective electric mobility.

The Strategic Imperative: Bridging the Price Gap

TVS has consistently been among the top performers in India’s electric scooter sales charts, leveraging the iQube’s blend of performance, features, and brand trust. However, with the iQube’s starting price currently hovering around ₹1.04 lakh (ex-showroom) for its base 2.2 kWh variant, a significant portion of the Indian two-wheeler market – accustomed to sub-₹1 lakh petrol scooters – remains untapped for EVs. This is the crucial gap the TVS Orbiter aims to fill.

The decision to introduce a more affordable EV comes at a critical juncture. While government subsidies for electric vehicles have seen revisions, the underlying demand for sustainable and economical personal transport continues to surge. For TVS, the Orbiter isn’t just about expanding its product portfolio; it’s about solidifying its leadership by making electric mobility genuinely accessible and appealing to the average Indian commuter who prioritizes practicality and low running costs.

Design and Aesthetics: Simplicity Meets Practicality

Information regarding the TVS Orbiter’s specific design details is still emerging, but reports based on patent filings and industry expectations suggest a departure from the iQube’s familiar styling. The Orbiter is likely to adopt a more minimalist and utilitarian design, prioritizing cost-effectiveness and functionality over premium aesthetics or advanced features that might drive up the price.

Key design elements could include:

- Handlebar-mounted headlamp: Unlike the apron-mounted headlamp of the iQube, placing it on the handlebar cowl can simplify the front design and potentially reduce manufacturing costs.

- Integrated LED DRLs/Turn Signals: A distinct LED light bar stretching across the front and possibly the rear, reminiscent of design cues on TVS’s popular Jupiter 110, could serve as both daytime running lights and integrated turn signals, offering a modern touch without complexity.

- Flat Floorboard: This feature is highly valued by Indian consumers for its practicality in carrying groceries or small bags, and the Orbiter is expected to incorporate it.

- Upright Styling: The overall stance is anticipated to be upright, contributing to comfortable ergonomics for daily commutes.

- Potentially Larger Front Wheel: Some patent leaks suggest a slightly larger front wheel (possibly 14-inch) compared to the rear, which could aid in handling and ride comfort, while a smaller rear wheel might help in maintaining a manageable seat height and optimizing under-seat storage.

- Behind-the-apron storage: Expect practical storage compartments behind the front apron, similar to many conventional scooters, adding to its utility.

The focus will be on offering a robust and reliable scooter with good build quality – a hallmark of TVS products – ensuring it can withstand the rigors of Indian roads, even with fewer frills.

Powertrain and Performance: Efficient Urban Commuting

To achieve its aggressive price point, the TVS Orbiter is expected to feature a more cost-effective powertrain compared to the iQube. It will most likely utilize a hub-mounted electric motor, similar to the one found in the iQube’s base variants. This configuration simplifies the drivetrain and reduces mechanical losses. While specific power output figures are yet to be confirmed, the motor will be tuned for efficient urban commuting, offering sufficient pick-up for city traffic and a modest top speed.

The battery pack will be smaller than the iQube’s larger variants. It’s highly probable that the Orbiter will inherit the 2.2 kWh battery pack from the base TVS iQube 2.2 kWh. This battery capacity, known to deliver an IDC (Indian Driving Cycle) range of 94 km on the iQube, could offer a real-world range of around 75-85 km for the Orbiter, which is perfectly adequate for the majority of daily commutes in Indian cities.

Charging convenience will be key. While fast charging may not be a standard feature on all variants to keep costs in check, a standard portable charger for home charging will be included, likely offering a charging time of around 2 hours 45 minutes to 0-80% with the 2.2 kWh battery.

Features and User Experience: Essential and Accessible

The TVS Orbiter’s feature set will be curated to provide essential functionality without unnecessary complexities that add to the cost. Expect a basic digital instrument cluster, possibly an LCD unit, displaying crucial information like speed, battery charge, odometer, and trip meters. Advanced features like large TFT touchscreen displays, comprehensive smartphone connectivity with turn-by-turn navigation, and voice assist (common in premium EVs) are likely to be omitted or offered only in a top-end variant.

However, riders can still anticipate standard conveniences such as LED lighting for headlamp and taillamp, a comfortable single-piece seat, and practical under-seat storage (though possibly less than the iQube’s 30-32 liters). Riding modes (e.g., Eco and Power) are also likely to be included to allow riders to optimize between range and performance. Basic safety features like Combined Braking System (CBS) will be standard.

The emphasis will be on a no-nonsense, reliable, and easy-to-ride scooter that serves its primary purpose: affordable and practical daily transportation.

Price Point and Market Impact

The TVS Orbiter’s projected price point is its most critical differentiator. Expected to be priced significantly lower than the iQube, likely in the range of ₹80,000 to ₹1 lakh (ex-showroom), it directly targets the sweet spot for a massive segment of conventional scooter buyers. This pricing strategy will position it as a direct competitor to entry-level electric scooters like the Ola S1 X, Hero Vida VX2, and other budget-friendly options from emerging EV startups.

By offering a compelling value proposition that combines an affordable purchase price with low running costs, the Orbiter could be the catalyst that encourages a significant number of petrol scooter users to make the switch to electric. Its launch during the festive season is a shrewd move, aiming to capitalize on the surge in consumer spending during that period.

4.Ather EL e-scooter

Ather EL E-Scooter: Ather Energy’s Ambitious Leap into Affordable Electric Mobility

Ather Energy, a pioneer and one of the most respected names in India’s electric two-wheeler segment, is on the cusp of a transformative shift in its product strategy. Renowned for its premium, performance-oriented scooters like the 450X and the family-focused Rizta, Ather is now set to democratize its cutting-edge technology for a much broader audience. This strategic pivot will be spearheaded by the introduction of its all-new ‘EL’ electric scooter platform,

scheduled to be unveiled at the company’s highly anticipated Community Day in August 2025. While the specific name of the first scooter derived from this platform remains under wraps, the “Ather EL e-scooter” signifies Ather’s aggressive foray into the sub-₹1 lakh price segment, a crucial battleground for mass-market adoption.

The Strategic Imperative: Reaching the Next Billion

For years, Ather Energy has cultivated a niche for itself as a premium EV brand, offering advanced features, superior performance, and a robust charging infrastructure. However, the true volume game in the Indian two-wheeler market lies in the affordable segment, where millions of commuters seek cost-effective and reliable transportation. Until now, Ather’s portfolio, with even the Rizta starting close to ₹1 lakh, has largely missed this crucial segment.

The ‘EL’ platform is Ather’s direct answer to this market reality. It represents a fundamental re-engineering effort from the ground up, with the core objective of cost-efficiency and versatility. Ather aims to leverage its deep expertise in EV technology and manufacturing to create a range of electric scooters that are not only significantly more affordable but also maintain the brand’s hallmarks of quality,

smart features, and connected experience. This move is crucial for Ather to scale its operations, capture a larger market share, and solidify its position as a leading EV manufacturer in India. It aligns with the broader industry trend where even established players like Hero MotoCorp (with Vida VX2) and TVS (with Orbiter) are focusing on more accessible EV offerings.

The EL Platform: Engineered for Affordability and Scalability

The ‘EL’ platform is touted to be a versatile and highly cost-efficient architecture. Unlike merely stripping down existing premium models, Ather is undertaking a holistic approach to reduce manufacturing costs. This could involve:

- Optimized Chassis Design: A streamlined and potentially simpler frame design that uses fewer complex components or manufacturing processes.

- Localized Sourcing: A greater emphasis on sourcing components locally within India, reducing reliance on expensive imports, especially for critical elements like electric motors (e.g., exploring alternatives to Chinese-sourced magnets). This aligns with the “Atmanirbhar Bharat” initiative, enhancing supply chain resilience and reducing costs.

- Modular Battery Integration: While specific details are awaited, the ‘EL’ platform might introduce new battery configurations or even explore a Battery-as-a-Service (BaaS) model in the future. This approach, where the customer pays for the scooter chassis upfront and subscribes to battery usage, can dramatically lower the initial purchase price, making it accessible to a wider demographic. Even if a full BaaS model isn’t launched immediately, the platform will be designed to accommodate diverse battery capacities and types to cater to different price points and range requirements.

Anticipated Features and User Experience

While cost-effectiveness is paramount, Ather is known for its “smart” scooters, and the ‘EL’ platform will likely integrate a simplified yet intuitive connected experience.

- Display and Connectivity: Expect a digital instrument cluster, possibly a smaller TFT unit or a high-quality LCD, replacing the larger, more expensive touchscreens of the 450 series. It will still offer essential information like speed, battery level, range, and ride modes. Basic smartphone connectivity via the Ather app, providing features like ride statistics and charging station locator, is highly probable. Advanced features like Google Maps integration directly on the dashboard, comprehensive voice commands, or advanced gaming capabilities might be reserved for premium models or offered as optional upgrades.

- Software Ecosystem (AtherStack 7.0): The launch of the ‘EL’ platform will coincide with the debut of AtherStack 7.0, the next iteration of Ather’s proprietary software suite. This update promises enhanced features, improved ride data, and overall better connectivity, suggesting that even the affordable ‘EL’ scooters will benefit from Ather’s continuous software innovation, ensuring a “smart” riding experience.

- Charging Infrastructure (Next-Gen Fast Chargers): Ather will also unveil its next-generation fast chargers at Community Day 2025. These improved chargers aim to make public charging quicker and more convenient, benefiting all Ather owners, including those of the new ‘EL’ platform scooters. Ather’s existing extensive Grid network, which includes over 3,600 fast chargers (and also supports Vida EVs), will provide a significant advantage for users of the new affordable models.

- Practicality and Design: The design language of the ‘EL’ platform scooters is expected to be practical and family-friendly, possibly leaning towards a more conventional scooter silhouette to appeal to a broader audience, similar to the Rizta. Expect a flat floorboard for added utility, comfortable seating, and adequate under-seat storage. LED lighting for headlamps and taillamps will likely be standard for efficiency and modern aesthetics.

- Performance: The motor and battery configurations will be optimized for urban commuting, providing sufficient power for city traffic and a comfortable range for daily use. While specific figures are not yet public, an IDC range of 80-100 km and a top speed suitable for city roads (e.g., 60-70 km/h) can be anticipated for the base variants.

Pricing and Market Impact

The most critical aspect of the Ather ‘EL’ platform is its pricing strategy. Ather Energy has explicitly stated its intention to introduce scooters under the ₹1 lakh mark, with some reports even suggesting prices closer to ₹80,000 (ex-showroom) for the most affordable variants. This aggressive pricing will enable Ather to directly compete with mass-market leaders like the Ola S1 X, Hero Vida VX2, TVS Orbiter (upcoming), and various models from traditional players and new startups.

By offering a high-quality, tech-enabled electric scooter at such a competitive price, Ather aims to:

- Expand its Customer Base: Tap into the vast segment of consumers currently opting for petrol scooters due to EV price barriers.

- Drive Mass Adoption: Accelerate the overall transition to electric two-wheelers in India by making EVs a more compelling and accessible choice.

- Leverage Brand Trust: Utilize Ather’s strong reputation for product quality, performance, and after-sales service to build confidence among new EV buyers.

Furthermore, Ather is aggressively expanding its retail network, planning to double its Experience Centres from the current 351 to 700 across India by March 2026. This extensive reach will be crucial for sales, service, and providing charging support for the new ‘EL’ platform scooters.

5.Yahama RY01

Yamaha RY01: Yamaha’s Performance-Oriented Electric Ambition for India

Yamaha Motor Company, a brand synonymous with performance, innovation, and a rich racing heritage in India’s two-wheeler landscape, is finally making its much-anticipated foray into the electric scooter segment. After years of speculation and strategic evaluation, Yamaha is set to launch its first electric scooter for the Indian market, internally codenamed RY01. This isn’t just another electric scooter; it represents a significant strategic shift for Yamaha, prioritizing a performance-first approach, and is being developed through a unique collaboration with Bengaluru-based EV startup, River.

The RY01 is slated for production between July and September 2025, with an expected showroom arrival by late 2025 or early 2026. This timeline positions Yamaha’s entry at a crucial point in India’s rapidly expanding EV market, where consumer demand for electric two-wheelers is surging, driven by fluctuating fuel prices, growing environmental awareness, and government incentives.

A Strategic Alliance: Yamaha and River

The development of the RY01 is a testament to the power of strategic collaboration. Yamaha Motor Co., Japan, made a significant $40 million investment in River’s Series B funding round in February 2024. This investment underscored not just a financial stake but a deep strategic alliance. While the “idea and product DNA are Yamaha’s,” River has been entrusted with the full execution responsibilities

, including R&D, powertrain development, battery integration, and manufacturing. This collaboration allows Yamaha to leverage River’s agility, engineering capabilities, and localized manufacturing strengths, ensuring a faster go-to-market readiness for the RY01, particularly in a price-sensitive yet performance-demanding market like India.

The RY01 will be largely based on River’s existing electric scooter, the River Indie. The Indie, often dubbed the “SUV of EVs” for its ruggedness and practicality, serves as a robust foundation. However, Yamaha’s global R&D teams from Japan, the U.S., and Europe are actively involved in the project, ensuring that the RY01 will carry a distinct Yamaha design identity and performance tuning.

This means while it shares core components and the platform with the Indie, the RY01 will feature unique styling elements that reflect Yamaha’s sporty and dynamic brand ethos. Spy images have already hinted at a redesigned taillamp, revamped side panels, and a reworked front apron with a new vertically oriented headlamp, deviating from the Indie’s more utilitarian look.

Performance and Powertrain: True to Yamaha’s DNA

Staying true to Yamaha’s legacy of performance, the RY01 is expected to deliver a potent riding experience. It will be powered by a 6.7 kW (approximately 9 hp) mid-mounted electric motor that produces a peak torque of 26 Nm. This configuration suggests a strong focus on acceleration and overall power delivery, aligning with Yamaha’s sporty brand image.

The scooter will draw its power from a robust 4 kWh Lithium-ion battery pack. This battery, likely a fixed unit integrated into the chassis, contributes to the scooter’s structural rigidity and handling. The most impressive figure related to the battery is the claimed IDC (Indian Driving Cycle) range of 161 km

on a single charge. This places the RY01 among the top contenders in terms of range in the Indian electric scooter market, addressing one of the primary concerns of potential EV buyers – range anxiety. With a claimed top speed nearing 90 kmph, the RY01 will be more than capable of handling city commutes and even occasional highway stretches with ease, living up to its performance-oriented positioning.

Features and Rider Experience: Premium and Connected

The Yamaha RY01 is poised to be a premium offering in the Indian electric scooter market, and its feature set will reflect this positioning. While specific details are still emerging, it is expected to borrow some of the best features from the River Indie while incorporating Yamaha’s own technological advancements.

Key anticipated features include:

- 6-inch Fully Coloured LCD/TFT Digital Screen: Providing a rich and clear display of essential information such as speed, battery level, range, ride modes, and possibly turn-by-turn navigation.

- Bluetooth-based App Connectivity: This will enable smartphone integration, offering features like call/SMS alerts, ride statistics, vehicle diagnostics, and potentially remote controls or anti-theft functions.

- OTA (Over-The-Air) Updates: Ensuring that the scooter’s software can be updated remotely, allowing for continuous improvements, new features, and bug fixes without the need for service center visits.

- Regenerative Braking: This essential EV technology will help extend the range by converting kinetic energy during braking into electricity, which is then fed back into the battery.

- All-LED Lighting: For superior illumination and a modern, premium look.

- 14-inch Alloy Wheels: Both front and rear wheels will be 14-inch units, contributing to better ride quality and stability on varied road surfaces, a unique selling point for the River Indie, which the RY01 is expected to retain.

- Suspension: A telescopic fork at the front and twin rear shock absorbers will provide a comfortable and stable ride.

- Braking: A disc brake at both front and rear (240mm front, 200mm rear) with a Combined Braking System (CBS) for enhanced safety.

- Practicality: Borrowing from the Indie’s “SUV of EVs” DNA, the RY01 is expected to offer practical aspects like a large and flat floorboard, ample storage (potentially similar to Indie’s 55 litres of combined under-seat and glovebox storage, plus pannier mounts), and sturdy crash guards.

Market Positioning and Competition

The Yamaha RY01 is expected to be positioned as a premium electric scooter, likely priced in the range of ₹1.40 lakh to ₹1.70 lakh (ex-showroom). This places it in direct competition with established and strong players in the high-performance and feature-rich electric scooter segment, including:

- Ather 450X and 450 Apex: Known for their performance, advanced features, and extensive charging network.

- Ola S1 Pro: A volume leader with aggressive pricing and a wide range of features.

- TVS iQube S/ST: TVS’s premium iQube variants offering good range and features.

- Bajaj Chetak Premium: Bajaj’s stylish and reliable electric scooter.

- Upcoming Honda Activa e: Honda’s much-anticipated entry, which will likely leverage the Activa brand’s trust.

Yamaha’s strategy appears to be a calculated one: instead of chasing mass-market volume from day one with an ultra-affordable model, it’s focusing on its core brand strength – performance and reliability – to carve out a premium niche. This aligns with Yamaha’s long-standing image as a manufacturer of sporty and exciting two-wheelers. The Indian market, while price-sensitive, also has a growing segment of consumers willing to pay a premium for superior performance, build quality, and advanced features.

Global Implications

Beyond India, the RY01 holds significant global implications for Yamaha. It will not only be manufactured in River’s facility in Bengaluru but is also intended for export to international markets, leveraging River’s cost-efficient production capabilities. This “India-first” development approach, bypassing Yamaha’s existing global EV platforms, signals a major repositioning for the company, placing India at the center of Yamaha’s electric vehicle ambitions for certain markets.

This collaboration allows Yamaha to accelerate its entry into the zero-emission vehicle space globally, demonstrating a new model for legacy manufacturers to partner with agile EV startups to drive innovation and achieve faster market readiness.

READ MORE-CLICK HERE

MORE INFORMATION-CLICK HERE

Conclusion:

The Indian electric scooter market is on the cusp of an exhilarating transformation, with the next 7-9 months, extending into early FY26, promising an unprecedented influx of at least five crucial new models. This surge is a direct response to the phenomenal growth witnessed in the electric two-wheeler segment in FY25, signaling a clear shift in consumer preference and strategic intent from leading manufacturers.

The upcoming launches from established players like Hero MotoCorp (Vida VX2), TVS (Orbiter), Ather Energy (EL-platform scooter), Suzuki (e-Access, Burgman Electric), and Yamaha (RY01) signify a definitive move by mainstream brands to capture a larger slice of the burgeoning EV pie. These aren’t just incremental updates; they represent a concerted effort to address diverse market needs, ranging from ultra-affordable entry points to performance-oriented premium offerings.

What’s particularly noteworthy is the strategic diversity:

- Hero Vida VX2 and TVS Orbiter are set to democratize EV ownership by focusing on highly aggressive pricing, leveraging modular battery options and potentially innovative ownership models like Battery-as-a-Service (BaaS).

- Ather’s EL-platform scooters aim to bring its renowned smart technology and premium experience to a more accessible price point, widening its appeal.

- Suzuki’s e-Access and Burgman Electric mark a significant push from a legacy player known for reliability, while Yamaha’s RY01, developed with River, promises a performance-oriented entry, staying true to its brand DNA.

This wave of new launches is poised to intensify competition, drive innovation, and ultimately offer Indian consumers a wider, more compelling array of choices than ever before. The fierce rivalry will likely lead to better features, more robust technology, enhanced charging solutions, and competitive pricing, all of which are essential for accelerating India’s transition to sustainable electric mobility. The “electrifying surge” is not just a phrase; it’s the reality that will shape the future of urban two-wheeler commuting in India.

(FAQs)

1. Which are the 5 new electric scooters expected to launch in India by early FY26? The five key models expected are:

- Hero Vida VX2 (Hero MotoCorp)

- TVS Orbiter (TVS Motor Company)

- Ather EL-platform scooter (Ather Energy)

- Suzuki e-Access (Suzuki Motorcycle India)

- Yamaha RY01 (Yamaha Motor Co.)

2. What is the approximate launch timeline for these new electric scooters? Most of these models are expected to launch within the next 7-9 months, primarily between July 2025 and early 2026.

- Hero Vida VX2: July 2025

- Suzuki e-Access: June/July 2025

- TVS Orbiter: October 2025 (Festive Season)

- Ather EL-platform scooter: First models after August 2025 (Community Day unveil)

- Yamaha RY01: Late 2025/Early 2026

3. What price range can I expect for these new electric scooters? The prices will vary significantly depending on the brand and features:

- Affordable Segment (Sub-₹1 Lakh Ex-showroom): Hero Vida VX2 (especially with BaaS), TVS Orbiter, and Ather EL-platform scooters are targeting this segment.

- Mid-to-Premium Segment (₹1 Lakh – ₹1.7 Lakh Ex-showroom): Suzuki e-Access, Suzuki Burgman Electric, and Yamaha RY01 will likely fall into this range due to their features, performance, or brand positioning.

4. Will these new scooters offer swappable batteries? Some models, like the Hero Vida VX2, are expected to feature swappable or removable battery packs, offering flexibility for charging and potentially enabling Battery-as-a-Service (BaaS) models. Others like Suzuki e-Access and Yamaha RY01 are expected to have fixed batteries.

5. What kind of range can I expect from these upcoming scooters? Expected IDC (Indian Driving Cycle) ranges will vary:

- Affordable models (e.g., Hero Vida VX2 2.2 kWh, TVS Orbiter 2.2 kWh): Around 90-100 km.

- Premium/Performance models (e.g., Yamaha RY01 4 kWh): Upwards of 160 km.

6. Will these scooters have smart features and connectivity? Yes, most new electric scooters, even in the affordable segment, are expected to come with some level of digital instrument clusters and smartphone connectivity (Bluetooth-based for basic alerts, navigation assistance via app). Premium models will offer more advanced TFT displays and comprehensive app features.

7. How are these new launches expected to impact the Indian electric scooter market? These launches are expected to:

- Intensify competition, leading to better features and more competitive pricing.

- Accelerate mass-market adoption of electric scooters due to increased affordability and variety.

- Encourage further development of charging infrastructure.

- Push existing players to innovate and upgrade their offerings.

8. What challenges might these new scooters face in the market? Key challenges include:

- Charging Infrastructure: While expanding, a robust public charging network is still developing.

- Battery Cost/Replacement: The long-term cost and perception of battery replacement remain a concern for some buyers.

- Government Subsidies: The current GST structure (43% for EVs vs. 5% for electric two-wheelers) remains a concern for pricing.

- Consumer Awareness: Educating consumers about the benefits and ownership experience of EVs is still ongoing.

9. Are these new scooters being manufactured in India? Yes, a significant focus is on local manufacturing to achieve competitive pricing and leverage government initiatives like “Make in India.” Models like the Hero Vida VX2, TVS Orbiter, Ather EL-platform scooters, and Suzuki e-Access are expected to be locally produced. The Yamaha RY01 is also being developed and manufactured in India through its partnership with River.

10. How do these compare to existing popular electric scooters like the Ola S1 Pro or Ather 450X? These new models aim to either:

- Compete directly: Offering similar features and performance at competitive prices.

- Expand market segments: By introducing more affordable options (e.g., Hero VX2, TVS Orbiter, Ather EL) or specialized performance/utility vehicles (e.g., Yamaha RY01, Suzuki Burgman Electric) to cater to different consumer needs not fully met by current leader